Would it help if your employees could bring home $100–$150 MORE per month while you reduce payroll taxes—without changing your plan? (All w/No Net Cost Increase)

Employees typically see a $100–$150/month net‑pay increase. Employers are able to realize ~$639.96 per employee per year ($53.33/employee/month) in tax savings — and the program is effectively no net new cost when structured correctly.

Built on an integrated §105 SIMERP participatory wellness design; aligned with IRC §§106(a), 105(b), 213(d), §125 and ACA participatory guidance. HIPAA/ERISA/ADA aware.

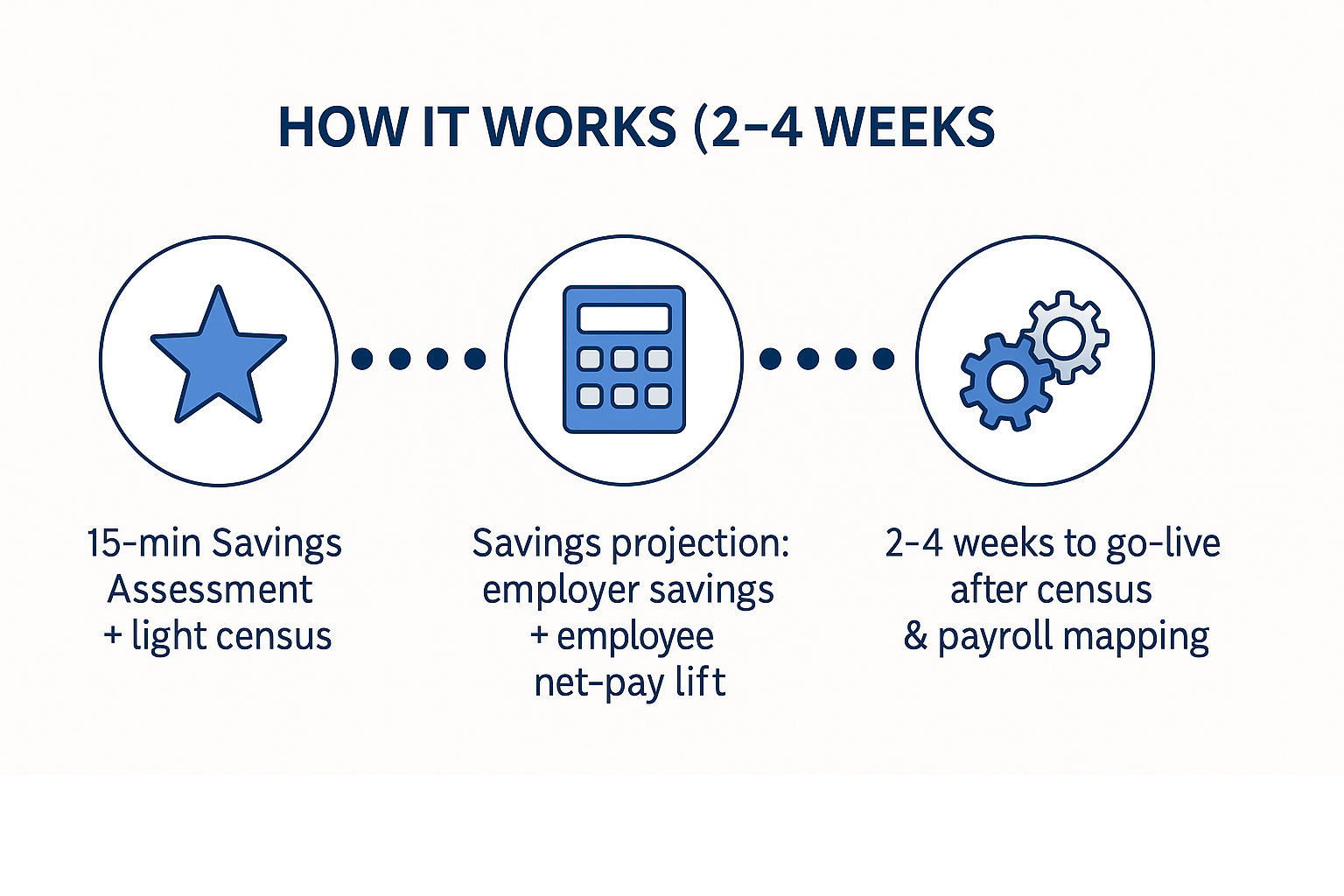

How it Works

This is an add‑on alongside your current health plan. Nothing is replaced. The structure combines pre‑tax eligibility with sponsored services to increase employee net pay and lower employer taxes.

We start with a light census to validate employer savings & employee net‑pay lift.

Receive a clear pro‑forma and a brief compliance overview for counsel/broker.

Turnkey communications and payroll file mapping with test validation.

Employees access telemed, mental health, and $0 generics; payroll reflects net‑pay increase.

Built for Finance & HR

Sample Paycheck Effect

- Employee take‑home pay typically increases by ~$100–$150/month.

- Employer FICA burden decreases; savings accrue per participant.

- Primary medical plan remains unchanged.

What Employees Get

Why adoption is strong

When employees see a real net take-home pay increase and immediate access to care, opt‑in rates typically climb. With clear education, 85–90% adoption is common.

What stays at risk if nothing changes?

A few quick questions CFOs ask themselves before we run the numbers:

- How much payroll tax are we leaving on the table each year if eligible employees don’t participate?

- If employees are $100–$150 short in net pay each month, what does that do to retention, overtime, and recruiting costs?

- What’s the opportunity cost of waiting a quarter if launch takes 2–4 weeks?

- If we could fund $0 generics and virtual care from tax savings, how would that trend affect medical claims and absenteeism?

ROI Calculator (Illustrative)

Enter a few numbers to preview potential impact. We'll replace these with your actual census and payroll specifics during the Savings Assessment.

• What would this ${employer_savings} mean to EBIT this year?

• If your valuation multiple is 6–8×, what’s the implied enterprise value of annualized savings?

FAQs

Yes. The 15‑minute assessment uses a light census to confirm employer savings and the employee net‑pay lift. If it isn’t cash‑flow positive, we stop—no obligation.

No. This runs alongside your current plan as an additive, opt‑in program. No carrier change.

You likely continue to forgo available payroll‑tax savings, and employees remain $100–$150 short in monthly net pay—impacting retention, overtime, and recruiting costs.

Most groups launch in 2–4 weeks after payroll mapping and education are complete.

Once your numbers pencil out, we provide a brief and documentation for counsel/broker. The design is HIPAA/ERISA/ADA aware with §105 SIMERP integration.

We’ll deliver a pro‑forma and a “go/no‑go” brief. If approved, we finalize payroll mapping and education and go live.

Ready to run the numbers?

In 15 minutes we’ll show your projected employer savings and the employee net‑pay lift — with zero changes to your current plan.

Prefer to send details now?

Submit this short form and we’ll reply with your tailored pro‑forma and a quick “go/no‑go” brief.

We’ll use your information only to coordinate the assessment.